Overview: The Long-Term Rental Market in Prague During the COVID Months

This article presents up-to-date data on the state of long-term rentals in Prague, but first, a few facts that will help understand the broader picture of the real estate market in Prague.

Greater Prague is home to about 1,300,000 people. There are 600,000 apartments in Prague, of which approximately 500,000 are in buildings, 100,000 in houses and duplexes (Domech Rodinných), and around 31,000 are municipally owned apartments (Bytů je obecních). About one-third of Prague’s residents live in rental housing.

July 2020

July is the first month of the second half of the year, but July 2020 was unlike previous years. It was not characterized by vacations as usual, but instead by reports of the second wave of COVID-19.

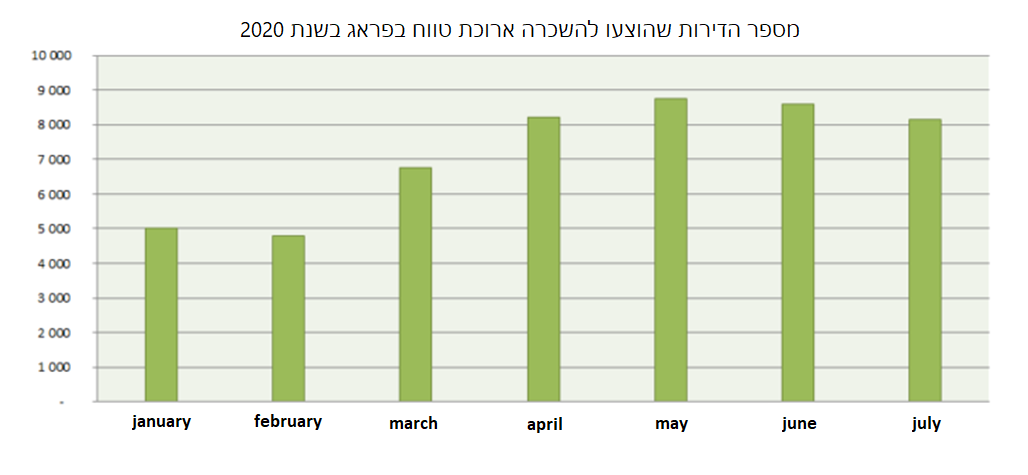

Rental Property Supply in Prague – July 2020

The total number of offices, restaurants, and commercial spaces in the rental market remained nearly unchanged in July 2020 compared to previous months. The only notable difference was the relatively low price of small office spaces.

The supply of small apartments in this market decreased compared to June, marking the second consecutive month of decline. This number had been steadily decreasing since mid-June, with the peak occurring at the end of May.

A closer look shows that once the lockdown was lifted in Europe and people began to move around the continent, the number of apartments offered for long-term rent in Prague 1, as well as small apartments (1–2 rooms), declined. It is likely that some landlords returned their properties to the short-term rental market.

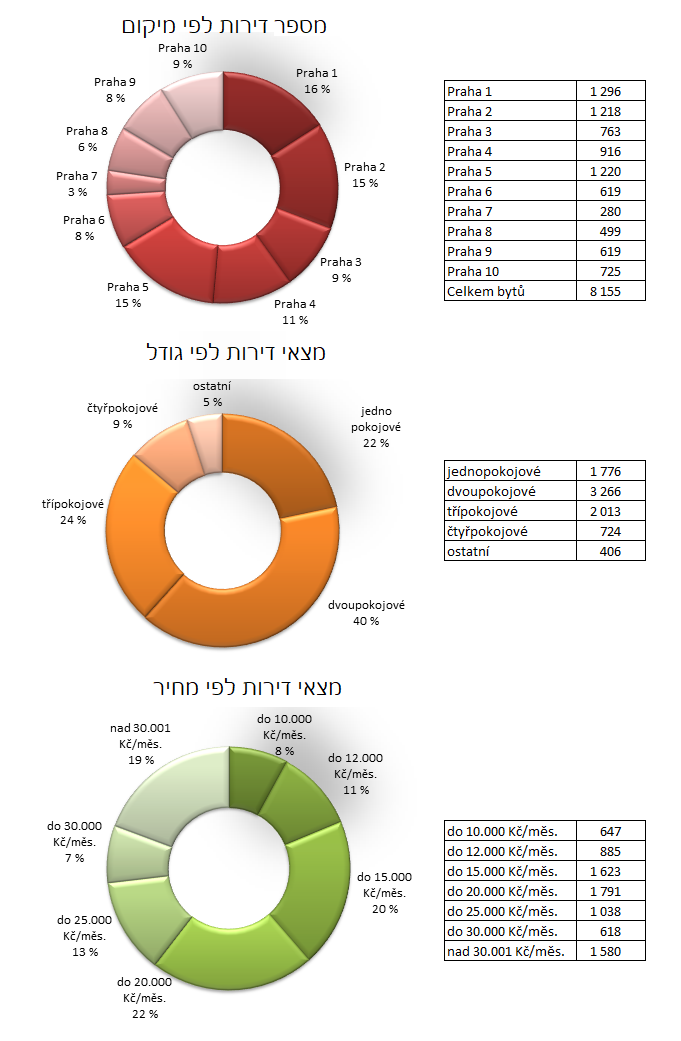

The following graphs show the number of apartments offered for rent in Prague in July 2020, based on various parameters:

Rental Demand in Prague – July 2020

In July 2020, there was a decline in demand for long-term rentals from foreigners. The number of people interested in renting apartments dropped, with declines seen among both workers and managerial-level employees.

While it is difficult to compete with the purchasing power of executives (who typically seek more expensive, non-standard apartments in the city center), the purchasing power of workers also declined, despite their general preference for standard apartments. This meant landlords struggled to find long-term tenants.

At the same time, there was a growing interest in co-living arrangements in large apartments with separate rooms and entrances, mostly among students.

Conclusion

The combination of summer vacations and the lifting of travel restrictions across Europe brought back some tourists to Prague, which in turn led to a resurgence in short-term rental listings. In fact, property owners in the Old Town and tourist districts returned their apartments to the short-term rental market. They had been waiting for the start of the summer tourism season.

June 2020

The sixth month of the first half of the year was marked by further easing of measures against the spread of COVID-19. Although there was cautious optimism, it could not be said that the real estate market had returned to its former state.

Rental Property Supply in Prague – June 2020

The increase in the number of apartments offered for long-term rent came to a halt. The total number of such listings stood at 8,598 at the end of June, compared to 8,758 at the end of May – a 2% decrease.

The overall decline was mainly in small apartments in the city center, resulting in an increased supply of large high-standard apartments and family houses.

At first glance, the visible changes were also reflected in the rental sector for non-residential real estate. The shift to working from home, changes in work styles, and economic difficulties forced many companies to terminate their leases, leading to an increase in the number of offices, commercial spaces, and restaurants available for rent—and on the other hand, a decline in demand for them.

Rental Demand in Prague – June 2020

In June 2020, most people searching for rental properties did not change their behavior. They were reasonable in their expectations and did not anticipate landlords to deviate from their usual practices. However, the number of apartments actually rented this month was lower than before March 2020. In cases where rent was expected to be paid by the company or employer, the decision-making process was more complex.

Conclusion

Although the first tourists began appearing in central Prague only in June, their numbers did not significantly impact the occupancy of short-term rental apartments. Their owners did not release them for long-term rental, as they were essentially waiting for the opening of Prague’s summer tourism season.

Since the tourist season was already underway, it is expected that this trend would continue—meaning that even during the summer holidays, these apartments would not be converted to long-term rentals. On the contrary, the summer vacation might lead to a decrease in interest in long-term rentals.

May 2020

In May, the long-term rental market was still significantly affected by the COVID-19 crisis, even though certain restrictions had been lifted.

Rental Property Supply in Prague – May 2020

There was no significant change in the number of apartments converted from short-term to long-term rentals. However, the total number of apartments offered for long-term rent increased, with an average of about 100 new listings added each week.

The total number of apartments offered for rent in May 2020 was 8,758 at the end of the month—an increase of 7% compared to 8,191 at the end of April. After rental prices dropped in April, no further significant decline occurred.

Undoubtedly, apartments originally intended for short-term rental played a central role in the increased supply. However, not all of these units returned to the rental market, and only some were offered as long-term rentals, suggesting they may have been temporarily used for short-term stays.

In fact, these apartments distorted the overall supply of rental units. This was likely influenced by negotiations in May between the governments of most European countries, who began agreeing on the conditions for reopening their borders. This in itself raised hopes for the renewal of tourism before the summer holiday season began.

The additional increase in the number of available apartments was due to units vacated by tenants leaving Prague. Some of them were university students whose studies were interrupted, and others were tenants who stopped working due to the pandemic.

Rental Demand in Prague – May 2020

Demand for long-term rental apartments began to increase slightly compared to April this year.

Unusual Phenomena

A unique trend was the rise in the number of people who began considering moving to a new apartment—even those who hadn’t yet completed their previous lease term. They were looking for housing with improved quality, size, location, or price.

However, this was likely only theoretical interest. The best indicator of their seriousness was this figure: only one in four interested parties actually showed up to view the property at the scheduled time.

April 2020

The April 2020 rental market analysis is compared to the pre-COVID period, meaning January to April 2020.

- In January 2020, between 12,000 and 15,000 apartments in Prague were rented short-term, usually in the city center and mainly to foreign tourists. A significant portion of these apartment owners were foreign investors.

- In January 2020, around 5,000 apartments were offered for long-term rental and about 9,000 for short-term rental in Prague.

- In March 2020, with the implementation of COVID-related restrictions, short-term rental demand nearly disappeared, causing some owners to shift their rentals from short-term to long-term.

- Until March 2020, the number of rental apartments offered in Prague was considered insufficient. According to estimates, 20,000 apartments were lacking, even though between 4,000 and 6,000 new units were completed annually in previous years.

- In March 2020, due to limited income opportunities, many tenants in Prague struggled to pay rent; some even left the city after losing their jobs.

- Since March 2020, the Czech government initiated measures to ease the negative impact of COVID-19 restrictions. Some of these addressed tenants and property owners, such as rent deferral options, the cancellation of the property acquisition tax for buyers, and certain mortgage benefits.

The Future of Renting: An Equation with at Least Two Unknowns

It is difficult to assess the impact of 15,000 apartments returning to the market (if their owners actually do so), alongside the completion of new apartments, both in addressing the current shortage of available housing and the unknown number of unemployed individuals. Until now, one in every 13 workers in Prague was employed in tourism-related fields—but not all of them lived in Prague.

In April, there was an increase in long-term rental demand while rent prices continued to fall. As a result, many potential tenants preferred not to rent yet, assuming the trend would continue and prices would drop further.

At the same time, the number of long-term rental listings in Prague rose by 1,583—from 6,744 units on April 1st to 8,327 units on April 30th, 2020—an increase of 23.4%. Most of them were apartments originally intended for short-term rental, small apartments (1–2 rooms), and units in Prague 1.

- Ongoing real estate updates on the COVID-19 situation in Prague.

Frequently Asked Questions

Absolutely! Since about one-third of the city’s population rents their home, buying an apartment for rental in Prague is considered a safe investment with strong returns.

Yes! Short-term rental platforms (such as Airbnb) are legal in Prague, with the aim of attracting tourists and solidifying Prague’s status as a year-round tourist city. Prague is one of the only cities in the world where this is legal, so take advantage of this opportunity and enjoy very high returns.

The main tourist area in Prague is the city center (Prague 1), making it the ideal zone to purchase real estate for short-term rental. Use the links below to learn more about <a href=”https://conbiz.eu/good-neighborhoods-for-investment-in-prague/”>the various neighborhoods of Prague</a>, <a href=”https://conbiz.eu/districts-of-prague/”>the city’s districts</a>, and their investment opportunities.

The COVID-19 pandemic affected many aspects of life in Prague, including real estate. Nevertheless, property prices in the Czech Republic and particularly in Prague continued to rise in 2020 and 2021.