How Much Do Rents in Prague Rise Each Year?

The rental market in Prague has become, over the past decade, one of the most dynamic and expensive markets in Central Europe. On the one hand, the city attracts new residents, students, foreigners, and investors from all over the world. On the other hand, the pace of construction is relatively slow, the supply is limited, and the result is a sustained increase in rents. One of the key questions for investors is not only how much it costs to rent an apartment today, but what the average rate of rent growth is over time, and whether it can serve as a solid basis for a sound financial model.

This article is based on various academic studies, Deloitte indices, data from the Association of Apartment Owners in the Czech Republic, and recent economic publications. All figures refer to nominal data, before deducting inflation, and are valid as of 2025.

How much does it cost to rent an apartment in Prague today?

To understand the rate of growth, we first need to understand the current price level.

The Deloitte Rent Index for the third quarter of 2025 indicates an average rent of approximately 456 Czech crowns per square meter per month for Prague as a whole, while the central and most sought after districts (such as Prague 2) exceed 490 crowns per square meter.

Various websites, such as Investropa, which rely on data from local apartment portals in mid 2025, sometimes report a slightly lower average, on the order of 380 Czech crowns per square meter.

For a landlord or investor, this means that for a one bedroom apartment (2+kk) of 55-60 square meters in Prague, the current average monthly rent is in the range of 22-27 thousand crowns per month, while apartments in the historic center and in the most desirable areas of Prague can significantly exceed this range.

Average rent growth over the past decade

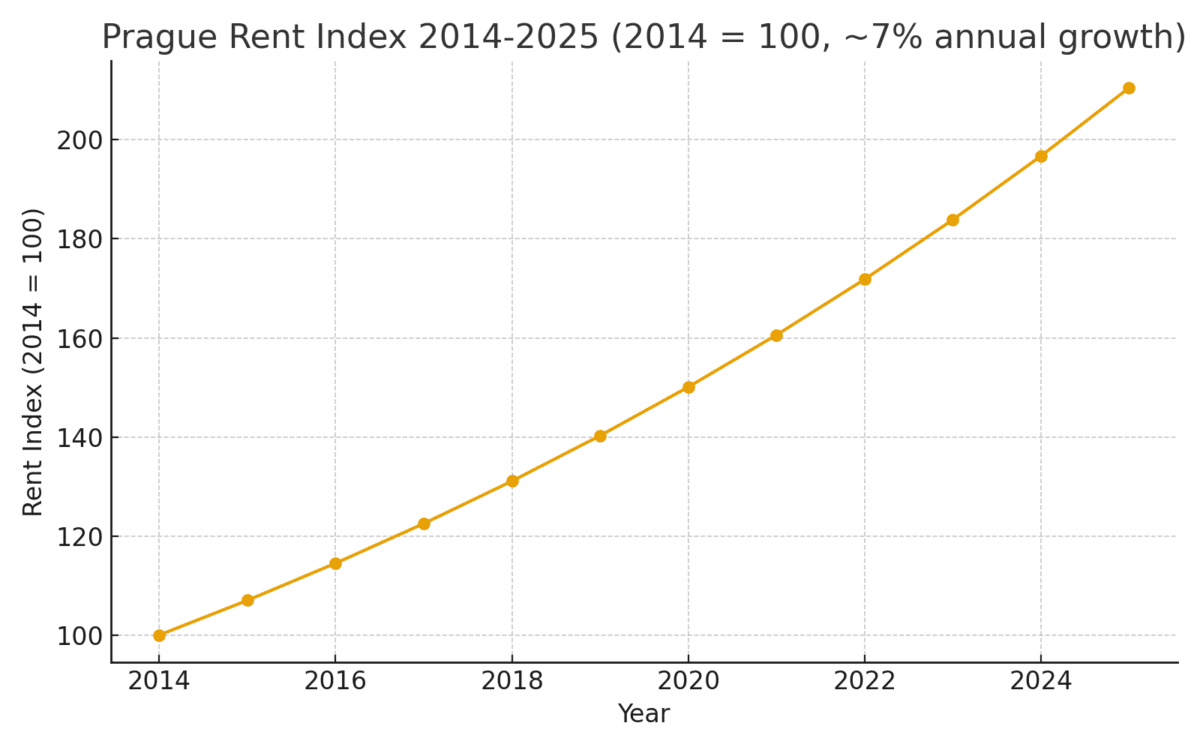

Between 2014 and 2024, the average rent in the city increased at a rate of approximately 7 percent per year, mirroring the pace of overall wage growth in Prague.

Data from the Association of Apartment Owners in the Czech Republic (ANB), cited in our comprehensive review of the Czech residential market for 2024, also support this. According to the association, rents across the country increased by about 7-8 percent in 2023 alone, with Prague leading the way.

Put simply, when looking at the period between 2014 and 2024, we can speak of an average annual rent increase of around 7 percent in Prague. This is, of course, a statistical average over a decade, not a fixed rate that repeats itself every year.

Volatility: from Covid era declines to double digit jumps

The figure of “7 percent per year” hides a rather significant roller coaster behind it.

In 2020, during the Covid 19 crisis, the Prague rental market experienced an exceptional shock: thousands of Airbnb apartments shifted from the tourist market to the long term rental market, and the supply of apartments for rent jumped almost overnight. Rents in Prague then fell by around 25 percent compared with peak levels.

After Covid, the picture changed very quickly. The return of tourists, the return of many apartments to the short term market, the influx of refugees from Ukraine, and the difficulty for young families to buy a home due to purchase prices and rising interest rates all created a renewed shortage of rental apartments. In 2022-2024, persistent reports pointed to sharp increases in rents, and in some years these were double digit increases.

An article published on Expats.cz at the beginning of 2024, based on the Deloitte Rent Index, showed that in some Prague districts (for example Prague 2) an annual increase of more than 4 percent was recorded in the last quarter of 2023 alone, while in others there were even temporary decreases. A more recent article, from February 2025, points to expectations of at least a 10 percent increase in average rents in Prague, driven by the continuing shortage of supply.

The bottom line: the average rate of increase over the last decade is about 7 percent per year, but within that decade there were years of decline or stagnation and years of very rapid growth on the order of 10-15 percent per year.

Differences between districts and apartment types in Prague

From an investment perspective, it is important to understand that not all apartments and not all districts experience the same rate of change in rents.

The Deloitte Rent Index for the first quarter of 2025 shows that the most expensive districts for renting are Prague 2 and Prague 3, where the average monthly rent exceeds 478 crowns per square meter. More peripheral districts, such as Prague 9, are still relatively affordable (around 420-430 crowns per square meter), yet at the same time display particularly fast growth, indicating rising demand in the suburbs and in developing areas.

In addition, the type of apartment plays a significant role. Rent per square meter in small units (studio and 1+kk) tends to be higher, competition for them is strong, and they are more sensitive to changes in demand from students and foreigners. Apartments of 2+kk and 3+kk in good locations typically benefit from a balanced combination of stable demand from families and couples and high occupancy rates over time.

Comparison with the Czech Republic as a whole and with the European Union

To put Prague in a broader context, it is useful to compare the rate of rent increases in the city with the national and EU wide pace.

The rent price index for the Czech Republic as a whole, according to the HICP consumer price index series on FRED, rose from a base level of 100 points in 2015 to about 149.8 points in March 2025. This represents a cumulative increase of almost 50 percent over a decade, which translates into an average annual increase of roughly 4.1 percent in national rents.

Data analyzed on the basis of information from Eurostat show that over the same period the share of renters among all households in the Czech Republic increased from about 21.1 percent in 2014 to about 25.3 percent in 2024, indicating a shift from ownership to renting for part of the population.

For comparison, across the European Union as a whole, rents rose by only about 26-27 percent between 2010 and the end of 2024, a significantly lower pace than that recorded in the Czech Republic and especially in Prague.

The combination of a faster rate of increase than the European average and a chronic shortage of supply in Prague helps explain why the city is now ranked among the more expensive capitals in Europe in terms of rent relative to local income.

Can you rely on a 7 percent annual increase?

What does this mean in practice for an Israeli investor considering buying an apartment in Prague and renting it out long term?

From a historical perspective, there is a solid basis for assuming that the average nominal rent increase in Prague over the last decade was around 7 percent per year. However, this is an average figure over a highly volatile period, which included both years of sharp declines and years of double digit jumps.

For the purpose of building a robust financial model, you can use the following rule of thumb:

- Over a medium term horizon of 5-10 years, a conservative assumption would be nominal rent growth of about 5-7 percent per year in Prague, with the understanding that in some years the rate can be lower or even negative and in others significantly higher.

- For especially central and “hot” locations (Prague 1-3, highly demanded areas around metro lines and new projects), an optimistic scenario might assume 7-9 percent per year, but it is very important to run a more conservative scenario of 3-4 percent as well.

- In any case, it is important to remember that these are nominal increases. If inflation in the Czech Republic is high, part of the rent increase is eroded by the general rise in prices in the economy.

Looking ahead: what is likely to happen to rents in Prague in the coming years

Recent reports from professional bodies forecast that the upward pressure on rents in Prague is unlikely to ease in the near term, among other things due to a continued shortage of apartments, the entry of institutional investors into the rental market, and the ongoing shift from the ownership market to the rental market.

At the same time, large urban renewal projects and construction on former agricultural land are expected to add thousands of new apartments to Prague over the coming decade. However, according to Deloitte’s analysis and that of other bodies, the planned supply is far from closing the gap with demand, so in the foreseeable future there is no expectation of the market being “flooded” with rental apartments.

From an investor’s perspective, this means that upward pressure on rents in Prague is likely to continue, even if the pace moderates somewhat compared with recent years.