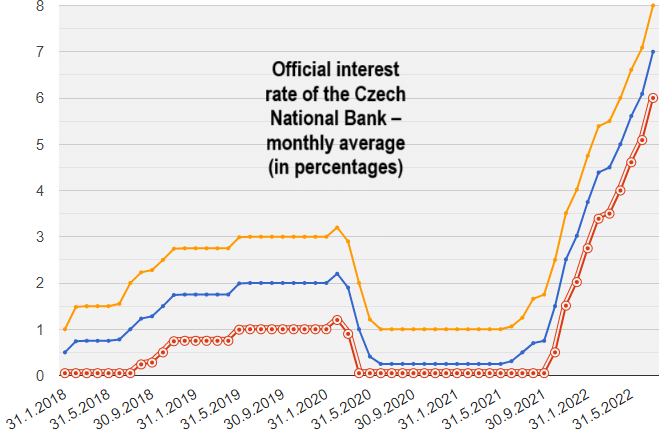

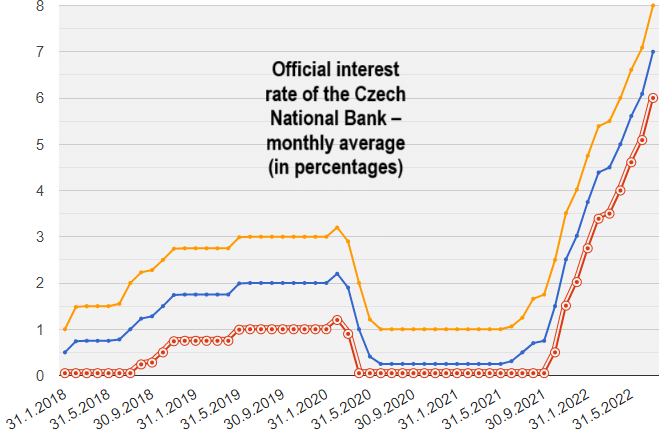

Official interest rate of the Czech National Bank – monthly average (in percentages)

In light of rising global inflation and frequent interest rate hikes, we found it important to update you on the latest changes and developments in Prague, their impact on the real estate market, and what is expected in the country going forward, based on assessments by Czech economists and analysts. Most importantly, we’ll highlight the current real estate investment opportunities created by this situation.

Inflation in the Czech Republic

Following COVID-related grants and the war in Ukraine, the Czech Republic has experienced shortages in essential food items, metals, and materials such as iron and wheat, alongside prolonged supply chain disruptions. Consumer goods prices started rising during the pandemic, and with the onset of the war, energy prices—especially gas, electricity, and fuel—surged, accelerating overall inflation and creating substantial pressure on the economy.

- In June 2022, inflation reached 17.2%

- In May 2022, inflation stood at 16%

Interest Rate Hikes in the Czech Republic

The Czech National Bank acted swiftly, initiating aggressive interest rate increases well before its counterparts in the European Union. As early as December 2021, the interest rate was raised by a full percentage point to 3.75%. By the end of July 2022, the bank had raised the rate to 7%, stating it would not hesitate to increase it further to curb runaway inflation.

Immediate Effects and Expected Impact on the Czech Real Estate Market

Despite the interest rate increases, inflation indicators have not yet shown significant improvement, largely due to the ongoing war in Ukraine and its continued pressure on energy prices. However, the impact on the real estate market has been immediate and noticeable—something we will now elaborate on.

Due to the rise in the base interest rate, commercial banks were forced to increase mortgage rates, which now stand around 7-8%. These rates have led to a significant slowdown in the real estate market, with most transactions coming to a halt.

Where Are Real Estate Prices Headed?

As every beginner investor knows, when demand drops, prices usually follow. But the Czech market operates under unique dynamics. A once seller-dominated market has shifted to favor buyers, increasing their negotiation power. Still, significant price reductions have not materialized, due to two main factors:

- A shortage of high-quality apartments in Prague. The supply remains tight, with no market saturation in sight.

- Czech property owners tend to be rigid in pricing and are not quick to lower asking prices. Also, the full impact of higher mortgage rates has not yet been felt.

Rental Prices in Prague

Unlike the sales market, rental prices are surging. During the COVID period, rents dropped by approximately 25% due to the exit of many short-term rental units from the tourist market.

In recent months, rental prices have rebounded significantly due to strong demand driven by around 350,000 Ukrainian refugees and the return of short-term rentals and tourism to Prague—though not yet at pre-pandemic levels.

What’s Next? Analyst Forecasts

Most Czech analysts expect interest rates to remain high or rise slightly in the coming year, possibly until mid-2023. After that, rates are expected to gradually decrease to around 4% or even 3% by early 2024.

A supporting indicator for this forecast is the appointment of Mr. Aleš Michl as the new Governor of the Czech National Bank in early July. Michl, known for opposing aggressive rate hikes, is expected to support a return to normal rate levels as soon as conditions allow.

Every Crisis Brings Opportunity

Second-hand Property Deals

Despite the challenges, now is the ideal time for cash deals. Buyers able to purchase real estate in the Czech Republic with cash can negotiate significant discounts, especially from sellers offloading assets due to rising interest costs (mainly investors who have already realized profits). Over time, even a slight price drop coupled with rising rental prices will improve yields considerably.

New Builds or Off-plan Deals

One of the more attractive investment options in the Czech market is purchasing a new apartment directly from a developer—during planning or early construction stages (off-plan). Typically, only about 15% of the purchase price is paid upfront, with the balance due upon completion, usually around two years later.

This structure increases the chances of obtaining a lower-interest loan in the future. The added bonus is the potential for substantial price appreciation once interest rates begin to drop. When that happens, all the buyers who were sidelined by high rates are expected to rush back into the market, driving up demand and prices. In a supply-constrained city like Prague, this scenario creates a strong foundation for price increases. Investors who enter now are well-positioned to benefit from the full upswing.

Interested in seizing this investment window and buying real estate in Prague? Leave us your details and we’ll get back to you shortly.